Phishing scams can come from fraudsters via text, email, or a phone call and often use an urgent tone to push you to act quickly.

They may pose as someone you know or as a legitimate organization to ask for an immediate payment or sensitive information.

Remember: Don't share your PIN, online banking password, or one-time access codes with anyone. Wells Fargo will not contact you and ask for this information.

Here are five steps to help spot, avoid, and report phishing attempts.

Step 1: Be alert. Know the phishing warning signs.

Phishing messages can use Artificial Intelligence (AI) to skillfully imitate your bank, a government agency, or another organization you recognize or trust.

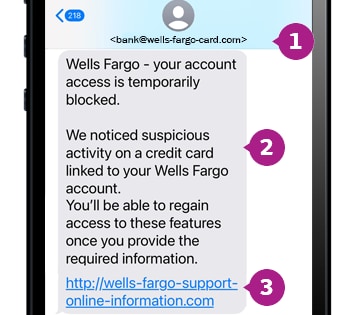

Here are two phishing examples that imitate Wells Fargo communications.

Phishing email example

- Beware of email addresses that do not include “wellsfargo.com.”

- Use caution with urgent alerts that ask you to act immediately.

- Avoid clicking on links or calling numbers you don’t recognize.

When in doubt, sign on to Wells Fargo Online® or contact us directly by calling the number on the back of your card.

Text phishing example

- Beware of senders using an address or phone number you don’t recognize. Common Wells Fargo short codes include 93557, 93733, 93729, 93767, 20342, 22981, or 93000.

- Do not respond to alerts that ask you to provide your private account access information.

- Avoid clicking on links or calling numbers you don’t recognize.

When in doubt, sign on to Wells Fargo Online® or contact us directly by calling the number on the back of your card.

Step 2: Pause. Go slow when you spot false urgency.

Phishing attempts often arrive as an urgent request.

Be suspicious of messages that announce a “problem” with your account or ask you to immediately log in to unlock your account, verify a transaction, make an online payment, or reverse a payment.

When asked to “act immediately,” do the opposite. Go slow and resist the urge to respond right away.

Step 3: Verify. Confirm the sender but don’t rely on caller ID.

Phishing attempts can be sophisticated and may even spoof (or imitate) caller ID to make the call look legitimate.

Don’t assume a communication can be trusted simply because it appears or sounds legitimate.

Contact the organization directly by going to their website.

To verify communications that appear to be from Wells Fargo, sign on using the Wells Fargo Mobile® app or type “wellsfargo.com” into a new browser tab to access Wells Fargo Online® directly.

Learn more about bank imposter scams.

Step 4: Stop. When in doubt, don’t respond.

When you receive an urgent request that doesn’t seem right, hang up or close the message. You aren’t being rude — you are being wise.

Actions to avoid:

- Do not sign on to your Wells Fargo account from a link embedded in a suspicious message

- Do not share personal account information such as your PIN, password, or one-time access codes

- Do not click any links or open attachments, which can install malware on your device

- Do not call phone numbers included in the communication

- Do not allow remote access to your computer

Tip

Step 5: Let us help. Report phishing if it happens.

Be sure to use the Wells Fargo Mobile® app to regularly monitor your account for suspicious activity. You can also turn on additional alerts to be notified of transactions and withdrawals.

If you’ve fallen victim to phishing

Call us immediately at 1-866-867-5568 if you clicked a link, opened an attachment, sent a payment, or provided personal or financial information in response to a suspicious message.

If you’ve spotted a phishing attempt

If you see a suspicious message mentioning Wells Fargo but didn’t click on the link or open any attachments, email the message to us at reportphish@wellsfargo.com and then delete it. You will receive an automated response.

If the suspicious message is unrelated to Wells Fargo, consider contacting that organization directly to report the incident.

When to report fraud

If you suspect you were the victim of fraud related to your Wells Fargo account, contact us immediately.

Learn more about how you can proactively help to protect your Wells Fargo account.

Sign On

Sign On